AI Infrastructure Costs: The Hidden Budget Multiplier Every CFO Must Track

AI infrastructure requires 4-40x more energy than traditional computing. CFOs miss this hidden cost multiplier. Model your expenses now.

While CFOs debate AI subscription pricing, infrastructure costs are systematically inflating budgets by 200-400%. Recent research shows 84% of companies report AI costs eroding gross margins by more than 6%, with energy and cooling expenses alone adding 10-40% to total AI spend. Yet organizations treating infrastructure as an afterthought face escalating costs that compound annually, while strategic CFOs are converting higher infrastructure investments into competitive advantages through geographic optimization and energy-efficient deployment strategies.

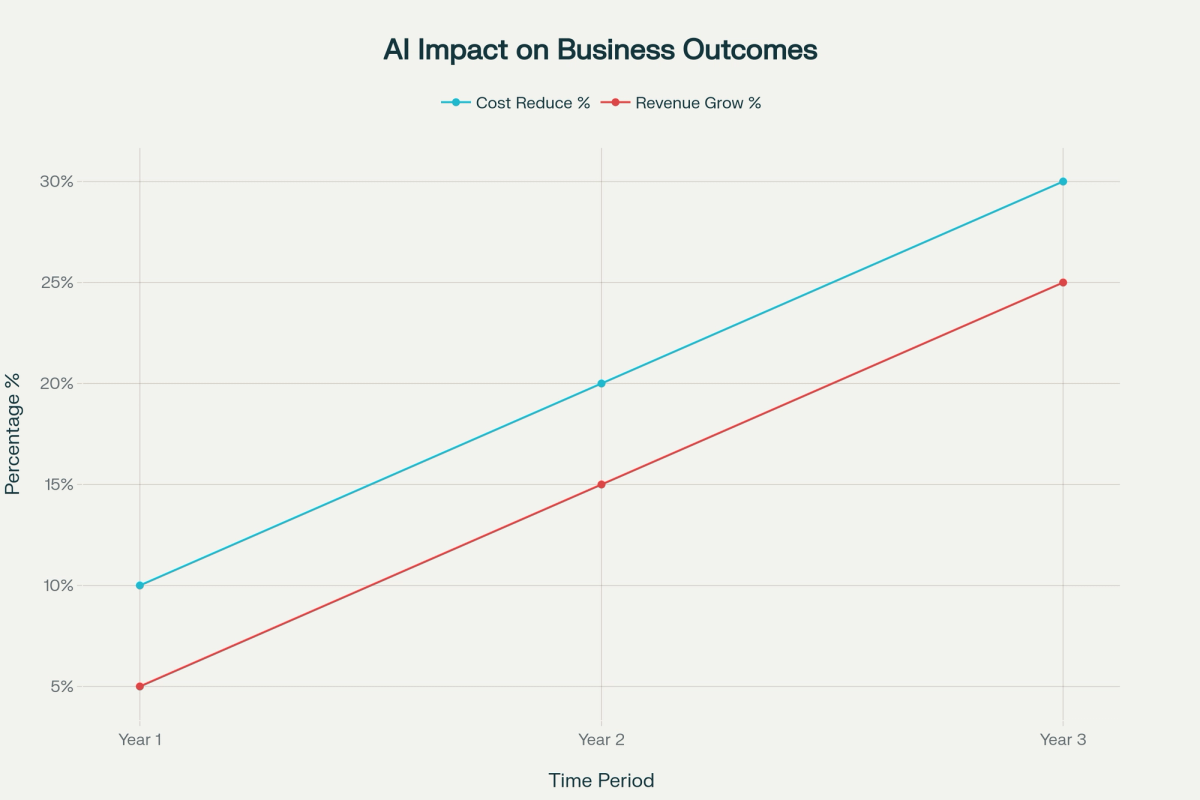

Just as manufacturing CFOs learned that factory efficiency matters more than equipment costs, AI infrastructure economics determine whether your AI initiatives generate profit or drain resources over time. And here's the paradox: despite these infrastructure challenges, 74% of CFOs view AI as a revenue driver, with Stanford research showing 70% of companies using AI in finance see revenue growth. The key is balancing infrastructure optimization with AI's proven ability to reduce operational costs by 10-30% when implemented strategically. Understanding these multipliers is only the first step—strategic CFOs need actionable frameworks.

The Scale of Hidden Infrastructure Multipliers

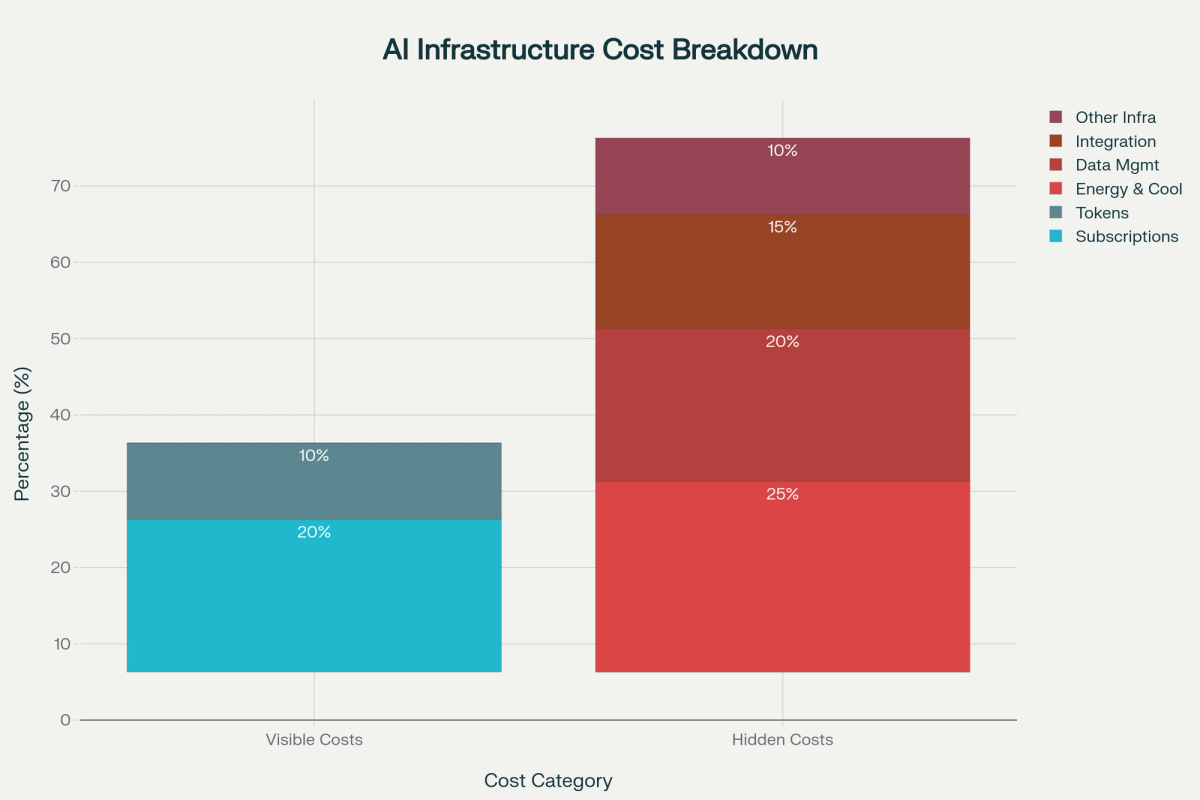

Enterprise AI infrastructure costs operate like an iceberg—the visible subscription and token fees represent roughly 30% of total expenses, while energy, cooling, integration, and operational costs comprise the remaining 70%. Recent industry analysis reveals that 42% of enterprise AI projects are abandoned before reaching production, with some CFOs underestimating implementation costs by up to 50-100% in 80% of enterprises.

Yet this same research reveals the upside: companies successfully implementing AI in finance operations achieve 20-30% operational cost reductions and 15-25% efficiency improvements within the first year. The difference lies in strategic infrastructure planning rather than avoiding AI altogether.

The Infrastructure Math:

Power Consumption Reality:

- AI workloads require 4-40x more energy per square foot than traditional computing

- A single AI query through ChatGPT requires 10x more electricity than a Google search

- Data centers already consume 4% of US electricity, projected to reach 12% by 2028

Energy Efficiency Gains:

- AI can deliver energy savings of up to 20% in buildings and 15% in transportation systems

- NVIDIA GPU acceleration shows 5x average energy efficiency improvements over CPU-only systems

- Advanced cooling strategies can improve PUE by 0.3-0.5 points, translating to 25-40% reductions in total energy costs

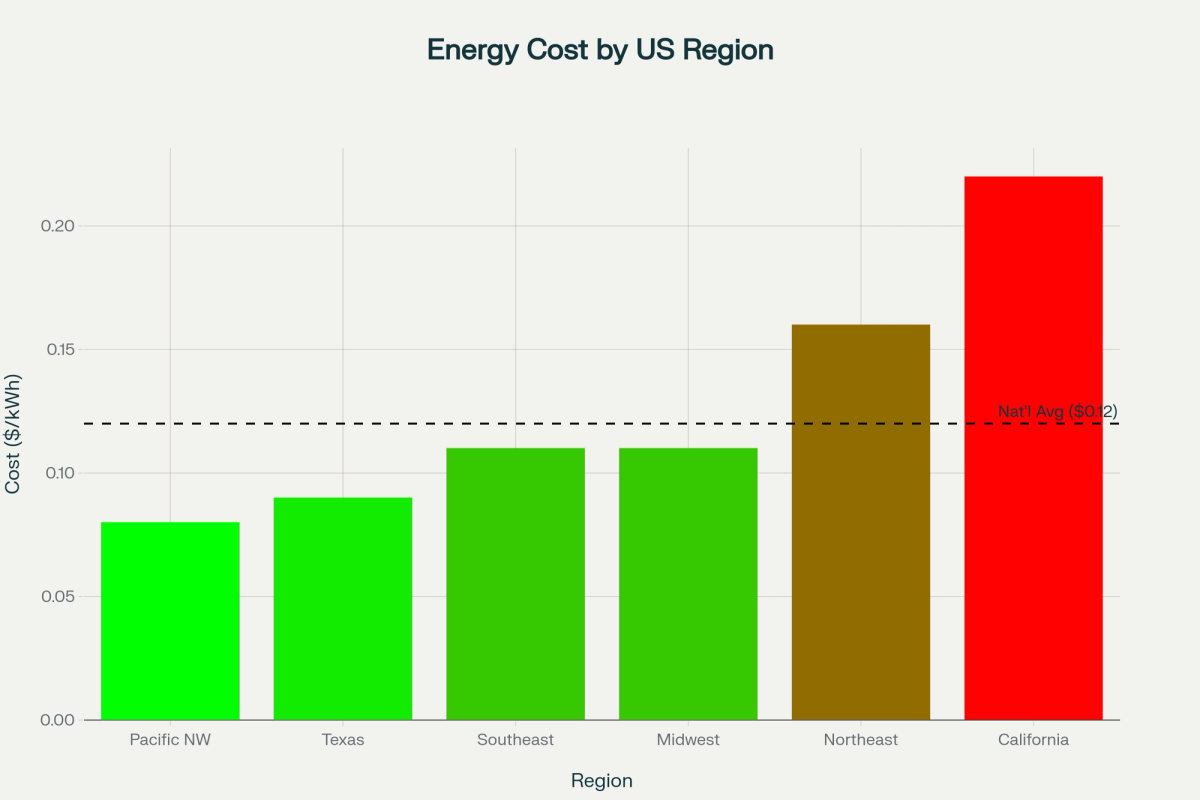

Geographic Cost Variations:

- Regional positioning creates 20-30% cost advantages that compound over multi-year deployments.

- Pacific Northwest data centers leverage hydroelectric power at $0.08/kWh versus California's $0.22/kWh—a 175% difference that directly impacts operational margins.

The CFO's Balanced Infrastructure Strategy

Research across 372 companies reveals that successful AI cost governance requires treating infrastructure as a strategic asset that enables revenue growth, not just an operational expense to minimize. CFOs achieving measurable ROI implement balanced frameworks that address both cost optimization and business value creation.

The Revenue Growth Context

Before diving into cost management, consider the broader financial impact: 72% of finance teams now use AI tools (up from 34% in 2024), with 70% of companies using AI in finance reporting revenue growth. The most successful applications include:

- Process automation: 66% of teams using AI report significant efficiency gains

- Financial forecasting: 58% report improved accuracy in budgeting and planning

- Risk assessment: 57% using AI for risk management see measurable improvements

Companies achieving the best results balance infrastructure investments with proven AI applications that reduce operational costs by 20-30% while driving revenue growth.

Infrastructure Optimization Framework

Pillar 1: Forecasting Discipline in Volatile Environments

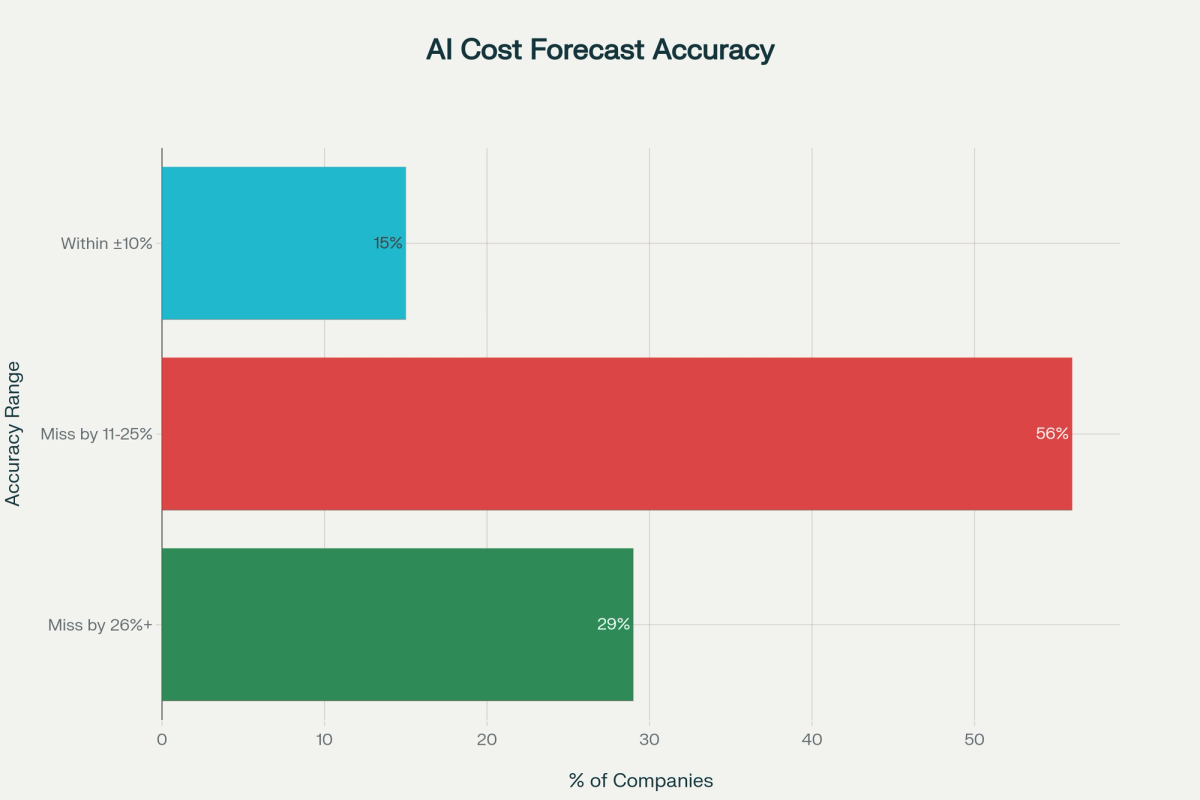

Traditional cloud forecasting models fail with AI workloads. Only 15% of companies forecast AI costs within ±10%, while 56% miss by 11-25%. However, organizations can achieve better predictability through:

- Real-time cost monitoring with automated alerts at 80% of monthly budgets

- Forecasting models capturing cost per inference and feature-level unit economics

- Target ±15% variance as a starting benchmark for mature AI deployments

Pillar 2: Geographic Energy Strategy

Infrastructure placement offers immediate 20-30% cost reductions through strategic positioning:

Regional Strategy Framework:

- Tier 1 (Lowest Cost): Pacific Northwest ($0.08/kWh hydroelectric), Texas ($0.09/kWh wind)

- Tier 2 (Moderate Cost): Southeast ($0.11/kWh nuclear/coal), Midwest ($0.11/kWh mixed)

- Tier 3 (Highest Cost): California ($0.22/kWh renewable mandates), Northeast ($0.16/kWh transmission constraints)

CFOs should evaluate workload placement based on total cost of ownership, not just latency requirements. Non-latency-sensitive AI training and batch processing workloads can achieve significant savings through geographic optimization.

Pillar 3: Efficiency-First Technology Choices

Leading organizations prioritize energy-efficient technologies that reduce infrastructure costs while maintaining performance:

- GPU Acceleration: NVIDIA systems show 5x average energy efficiency improvements over CPU-only operations

- Advanced Cooling: Liquid cooling systems can achieve 25-40% energy cost reductions through improved PUE ratings

- Hybrid Strategies: 67% of enterprises planning cloud repatriation to balance costs with performance

Pillar 4: ROI-Driven Use Case Selection

BCG research reveals that AI applications in risk management, financial forecasting, and fraud detection generate the highest ROI, often exceeding 20%. Yet most finance teams focus on lower-impact efficiency plays rather than these transformative applications.

High-ROI Applications:

- Risk Management: AI fraud detection delivers transformative cost avoidance

- Financial Forecasting: Cash flow modeling and sales planning improvements

- Statutory Accounting: Automated compliance and audit preparation

The Hyperscaler Investment Reality

Enterprise AI costs extend beyond direct subscriptions—they include infrastructure costs that hyperscalers pass through via higher service pricing. The scale is significant: hyperscalers invested $47.4 billion in AI hardware during H1 2024 alone, with global data center capex projected to grow at 21% CAGR through 2029.

Strategic Response:

Rather than avoiding these costs, successful CFOs negotiate fixed-rate contracts with defined annual increase caps (typically 8-12%) and evaluate hybrid deployment strategies that balance cloud scalability with on-premises cost control.

The Pass-Through Mechanics:

- Microsoft, Google, and Amazon building data centers requiring 2-5x more power than previous facilities

- Construction timelines averaging 7 years create supply constraints driving systematic price increases

- Organizations can mitigate through geographic diversification and multi-cloud strategies

Implementation Strategy for Different Organization Sizes

For Mid-Market Organizations ($50M-$500M Revenue)

Immediate Actions (0-90 days):

- Audit current AI spend to establish baseline visibility across all departments

- Implement usage monitoring with real-time cost tracking, not monthly retrospectives

- Focus on high-ROI applications like automated financial forecasting and risk assessment

Strategic Positioning (3-12 months):

- Select providers with transparent PUE ratings below 1.3 and renewable energy commitments

- Negotiate fixed-rate contracts limiting infrastructure cost pass-through to 8-12% annually

- Evaluate serverless AI platforms that absorb infrastructure complexity through shared models

For Enterprise Organizations ($500M+ Revenue)

Advanced Infrastructure Strategy:

- Implement hybrid deployment balancing on-premises control with cloud scalability

- Negotiate direct energy partnerships for large-scale AI deployments in low-cost regions

- Develop multi-year energy cost models assuming 20-40% inflation through 2030

Revenue-Focused Approach:

- Establish infrastructure investment as enabler for high-ROI AI applications

- Implement cross-departmental chargeback mechanisms allocating true costs to business value

- Model total economic impact including both cost reduction and revenue enhancement

The Net Energy Efficiency Opportunity

Despite AI's energy intensity, research shows the technology's efficiency gains across the broader economy can offset its own consumption. PwC analysis suggests AI could boost energy efficiency enough to save as much energy as the technology uses over the next decade.

The Net Efficiency Math:

- AI applications can reduce energy consumption by 0.5-1.1% across the entire economy by 2035

- Manufacturing sees 10% facility energy efficiency improvements through AI-powered digital twins

- Financial services achieve 4x energy consumption reductions with GPU-accelerated systems

This creates a strategic opportunity: organizations implementing AI efficiently can achieve both cost reduction and sustainability goals while competitors struggle with unoptimized infrastructure expenses.

Looking Ahead: Infrastructure as Competitive Advantage

Infrastructure costs represent both the largest risk and greatest opportunity in AI budgets. Organizations that proactively model these costs—including energy inflation, cooling optimization, and geographic positioning—avoid budget surprises while converting higher infrastructure investments into competitive advantages.

The Strategic Framework:

- Revenue Growth: Use AI's proven 20-30% operational cost reduction potential to fund infrastructure investments

- Risk Management: Implement high-ROI applications like fraud detection that generate transformative returns

- Energy Efficiency: Leverage AI's net energy savings potential to reduce total organizational footprint

- Geographic Strategy: Achieve 20-30% cost advantages through strategic workload placement

CFO Takeaway:

This isn't about choosing between AI adoption and cost control—it's about strategic implementation that converts infrastructure investments into sustainable competitive advantages. Organizations treating AI infrastructure as a revenue enabler, rather than just an operational expense, will outperform competitors still focused exclusively on minimizing costs.

The CFOs achieving the best results balance the reality of infrastructure cost inflation with AI's proven ability to reduce operational expenses by 10-30% and drive revenue growth in 70% of implementations. Success requires strategic positioning, not cost avoidance.

Infrastructure costs for AI are like operating a high-performance factory: the subscription price for the machinery captures attention, but the power grid, cooling systems, and operational efficiency determine whether the operation generates profit or losses over time. The organizations that master both sides of this equation will dominate the next decade of business competition.

Research Limitations:

Cost projections reflect current energy market conditions and may vary based on regulatory changes, technology improvements, or significant renewable energy availability shifts. ROI figures represent industry averages and individual results will vary based on implementation quality and use case selection.

References

Primary Research Sources:

- Mavvrik's 2025 AI Cost Governance Report (372 companies surveyed)

- Stanford University's 2025 AI Index Report

- Lawrence Berkeley National Laboratory energy usage data

Industry Analysis:

- Salesforce CFO AI Investment Research

- McKinsey operational cost reduction studies

- Deloitte infrastructure demand projections

- BCG finance function ROI analysis

- PwC net energy efficiency modeling