AI Subscriptions vs. Tokens: Why Costs Rise Even as Prices Fall

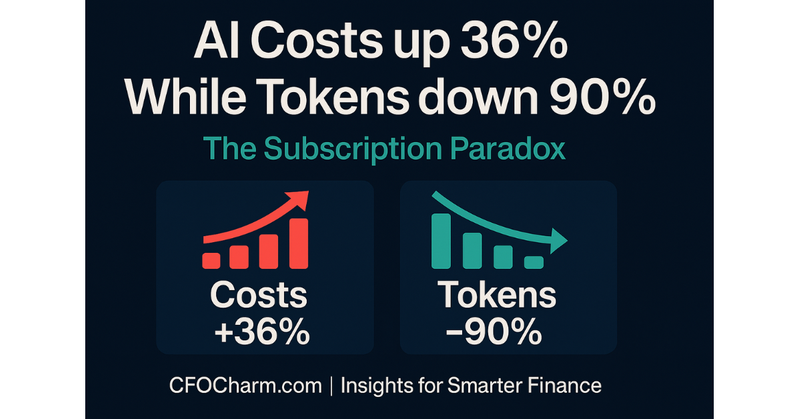

Despite falling token prices, CFOs report 36% monthly AI budget increases. Here's why the subscription model is winning and what it means for your IT spend.

Enterprise AI spending is projected to grow 75% year-over-year, and 100% of CFOs plan additional AI investments within the coming year. Yet while token prices on many model platforms keep sliding, the actual all-in AI spend is climbing rapidly.

As I have woven AI into my daily workflow—not as a side experiment, but as critical operational infrastructure—the core lesson is simple: No single AI platform meets every need, and each tool carves out a unique space in the workflow. That means real business users don't choose—they stack, creating new cost-management challenges.

The Multi-Platform Reality: Why AI Consolidation Hasn’t Arrived—Yet

It's too early to declare AI consolidation a failure; history shows that markets sometimes do swing back to single solutions. But for now—and likely for the foreseeable future—CFOs and consumers are left navigating an increasingly fractured landscape. Most real users must stitch together a growing collection of subscriptions and tech stack components just to cover their business needs.

In the interim, the result is unmistakable: instead of one clear vendor or unified platform, you get complexity, administrative overhead, and steadily ballooning costs. Until (or unless) the market consolidates, the burden falls on organizations and individuals to manage overlapping subscriptions and justify every new addition to their AI stack.

What makes AI particularly resistant to consolidation is the specialized nature of each model's strengths. Unlike ERP or CRM systems where standardization was feasible, AI models excel in distinct areas—Claude's reasoning capabilities differ fundamentally from GPT's general versatility or Grok's creative ideation. This specialization makes a true "one-size-fits-all" solution unlikely in the near term.

The enterprise software playbook promised consolidation—one vendor, one contract, predictable costs. For years, CFOs and CIOs pursued "single-suite" strategies: SAP for ERP, Salesforce for CRM, Microsoft for productivity. The promise was efficiency and simplicity.

But reality fractured. Best-in-class tools emerged in every category—Slack for collaboration, Zoom for meetings, Workday for HR, ServiceNow for IT workflows. Instead of one consolidated contract, enterprises now manage dozens of overlapping subscriptions, each indispensable in its niche.

It mirrors what happened with streaming at home. Cutting cable promised simplicity, yet most households now juggle Netflix, Hulu, Disney+, and more—because exclusive content is fragmented across platforms. What started as a way to save money and streamline access became a patchwork with a ballooning monthly bill.

The same story played out in financial services. Banks once promised to be the one-stop shop for payments and money movement. Today, businesses and consumers spread transactions across PayPal, Stripe, Square, Venmo, Zelle, and Apple/Google Pay. Each solves a unique problem, but the end result is higher costs and more complexity, not less.

AI is following this same arc—only faster. Each model and platform has carved out its specialty. Here is what I have observed in practice:

The enterprise software playbook promised consolidation—one vendor, one contract, predictable costs. For years, CFOs and CIOs pursued “single-suite” strategies: SAP for ERP, Salesforce for CRM, Microsoft for productivity. The promise was efficiency and simplicity.

But reality fractured. Best-in-class tools emerged in every category—Slack for collaboration, Zoom for meetings, Workday for HR, ServiceNow for IT workflows. Instead of one consolidated contract, enterprises now manage dozens of overlapping subscriptions, each indispensable in its niche.

It mirrors what happened with streaming at home. Cutting cable promised simplicity, yet most households now juggle Netflix, Hulu, Disney+, and more—because exclusive content is fragmented across platforms. What started as a way to save money and streamline access became a patchwork with a ballooning monthly bill.

The same story played out in financial services. Banks once promised to be the one-stop shop for payments and money movement. Today, businesses and consumers spread transactions across PayPal, Stripe, Square, Venmo, Zelle, and Apple/Google Pay. Each solves a unique problem, but the end result is higher costs and more complexity, not less.

AI is following this same arc—only faster. Each model and platform has carved out its specialty. Here is what I have observed in practice:

The Real-World AI Stack

- Claude excels in coding and technical reasoning. It doesn't just generate code snippets—it sustains complex analytical workflows, maintains context across lengthy financial models, and manages nuanced compliance documentation. For technical analysis and modeling, it's close to indispensable.

- OpenAI (ChatGPT) is the reliable generalist. It handles the lion's share of daily tasks, from drafting board presentations and summarizing long contracts, to building out initial analysis frameworks. That baseline consistency makes it the productivity backbone.

- Perplexity has replaced my research workflow. Instead of sifting through pages of Google results, I get concise, cited answers for market research, competitor benchmarking, and regulatory updates—saving hours every week.

- Microsoft 365 Copilot is now deeply embedded in enterprise workflows. At $30 per user per month, it's the premium option—but for organizations already integrated with Microsoft, the end-to-end workflow benefits often justify that cost.

- Grok, while still early and raw compared to others, regularly surfaces ideas that push my thinking in new directions. For exploring unconventional perspectives and surfacing edge cases, it has unique value.

While consolidation may eventually arrive, stacking remains the current reality. And just as in every other industry, the consumer bears the complexity and cost burden in the meantime. In AI, the math is relentless: when each platform provides unique value, you don't quit one for another. You stack subscriptions.

Consider a typical finance team of 10: ChatGPT Plus ($20/user), Claude Pro ($20/user), and Microsoft Copilot ($30/user) totals $700/month—before any API usage, specialized tools, or embedded AI in existing SaaS contracts. A typical finance professional's monthly AI outlay now reaches $60–$70, with enterprise users often exceeding $100.

The Token vs. Subscription Paradox

The industry narrative focuses on falling token prices, but CFOs live in a different reality. At the time of publishing, OpenAI's GPT-4o API costs $2.50 per million input tokens and $10 per million output tokens, while the smaller GPT-4o-mini runs at just $0.15 input / $0.60 output per million tokens. Meanwhile, Claude Sonnet 4 is priced at $3 per million input tokens and $15 per million output tokens.

Despite these falling unit costs, most professionals gravitate toward fixed subscription models, and here's why the math is counterintuitive:

- Subscriptions offer predictability. At $20–$30/month, users get "unlimited" access within fair-use limits, priority server access, and extended context windows—benefits that make budgeting easier than variable token charges that can spike unpredictably.

- Token pricing requires forecasting. A heavy user consuming 2 million tokens a month might spend ~$5 in input-only API charges with GPT-4o. In contrast, ChatGPT Plus costs $20/month. The API looks cheaper, but because most users can't accurately forecast usage, subscriptions feel safer and more controllable.

- Soft benefits justify the premium. Subscriptions provide more than raw compute—they bundle features like priority access during peak times, longer context windows, multimodal support, and integrated extras like image generation. These add-ons create value tokens alone don't.

- API keys don't replace subscriptions. An API key lets developers integrate models into apps or workflows—but it does not unlock the ChatGPT UI (chat.openai.com or mobile apps). To use ChatGPT directly, a separate subscription is required. That means many organizations pay both: subscriptions for general productivity and API usage for technical or product work.

- Stacked costs are the norm. Employees often expense direct subscriptions (ChatGPT Plus, Claude Pro, Perplexity Pro), while development teams consume API credits directly or indirectly via third-party SaaS tools like Cursor, Jasper, or Notion AI. In practice, the same core model (e.g., GPT-4o) may be billed multiple times—once as a subscription and again bundled inside vendor SaaS pricing.

The outcome? CFOs face rising AI costs despite falling token prices. Organizations report average monthly AI budget increases of ~36%, driven not by higher per-unit token costs but by expanding tool portfolios, overlapping subscriptions, and embedded API charges hidden within third-party SaaS contracts.

Want to See the Real Math?

Try the CFOCharm AI Token Calculator to see why predicting real spend is so tricky—token math changes across models, and even careful estimates can be off by ±20%. Accurate forecasting is tough, which is why most prefer the comfort of fixed subscription pricing even as their own stacks keep expanding.

Interested in broader cost control? Use our Tail Spend Optimization Tool to target hidden inefficiencies in your finance stack, from SaaS subscriptions to AI APIs.

CFOCharm's Mission

At CFOCharm, our mission is to empower CFOs and finance teams with curated insights, practical tools, and strategic guidance that transform financial operations while maintaining the rigor and compliance modern businesses demand. Sometimes the right financial decision isn't chasing the newest model, but using the right one for the task at hand.

- AI has crossed the Rubicon from experiment to infrastructure. The winners won't be the companies that simply spend the most—they'll be the ones that spend with discipline, balancing innovation with cost control. For CFOs, that's the new frontier of strategic leadership.